| |

|

|

| |

PF Withdrawal |

|

| |

As per PF Rules;

- PF can be withdrawn after 2 months from the date of leaving.

- Employer Contribution of PF can be withdrawn, if Employee has worked for more than 180 days.

- Employee & Employer contribtion of PF can be transfered to another Company where Employee has joined.

- Employee has to apply online for PF Withdrawal.

- For online PF Withdrawal, Aadhar No & Bank Details registration is Compulsory.

- For online PF Withdrawal, UAN Activation is Compulsory.

|

|

| |

Procedure for PF Withdrawal |

|

| |

PF Withdrawal can be applied through below mentioned Link. |

|

| |

|

|

| |

https://unifiedportal-mem.epfindia.gov.in/memberinterface/ |

|

| |

|

|

| |

Download Form 15G |

|

| |

|

|

| |

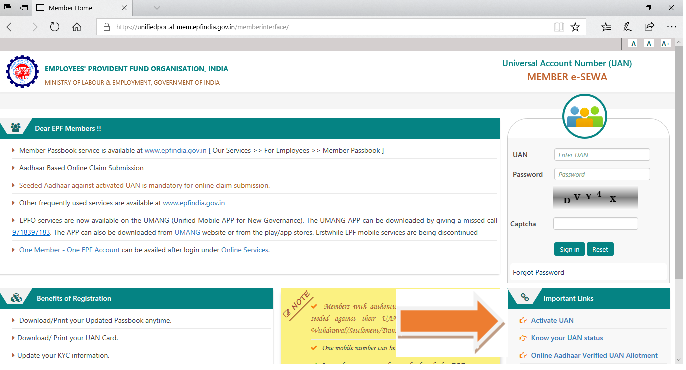

1. To Activate UAN click on "Activate UAN" as presented below. |

|

| |

|

|

| |

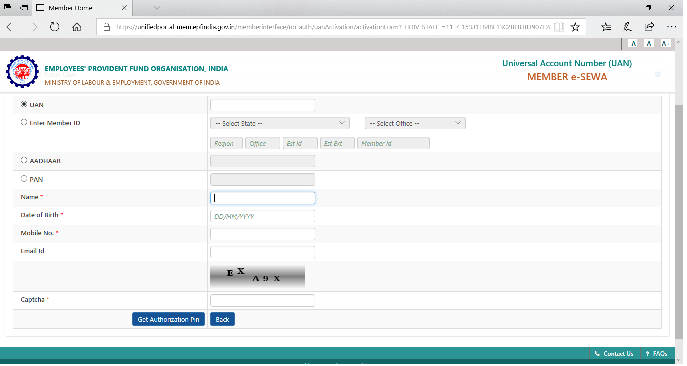

2. Enter details as per below screen. |

|

| |

|

|

| |

3. After entering above details, click on Get Authorization PIN, an PIN will be sent to employee’s registered Mobile Number. |

|

| |

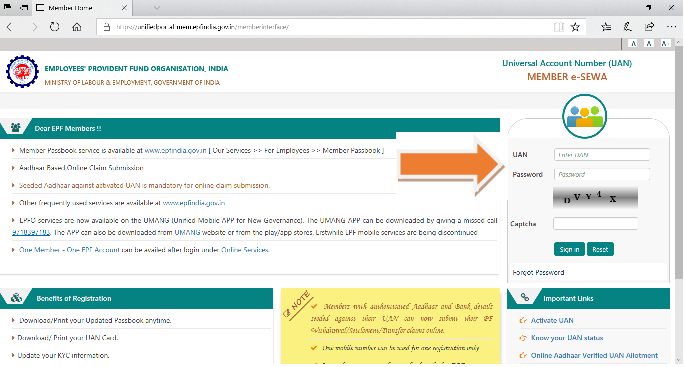

4. Employee can login in PF Withdrawal portal by entering his UAN and Password as PIN Received on his Mobile, through option displayed below. |

|

| |

|

|

| |

5. After Login, click on option displayed below, for PF Withdrawal and fill details |

|

| |

|

|

| |

|

|

|

Perfect enroller India Pvt. Ltd.

603, Agrawal B2B,

Ramchandra Lane Extension, Kanchpada,

Malad (W), Mumbai 400064 INDIA.

For Any Assistance, Call us on Phone No. : 022 35643596 or Write to us at : hr@perfects.in

Office Timing (Except National,State Holiday) :

Monday to Friday : 11.00AM to 7.00PM

Saturday : 11.00AM to 3.00PM

|

|

| |

|

|

| |

|

|